Although the U.S. economy is well into a healing from the depths of the COVID-19 crisis, there’s been lots of news along the method that might have damaged markets or resulted in a more continual correction. So far, that hasn’t occurred.

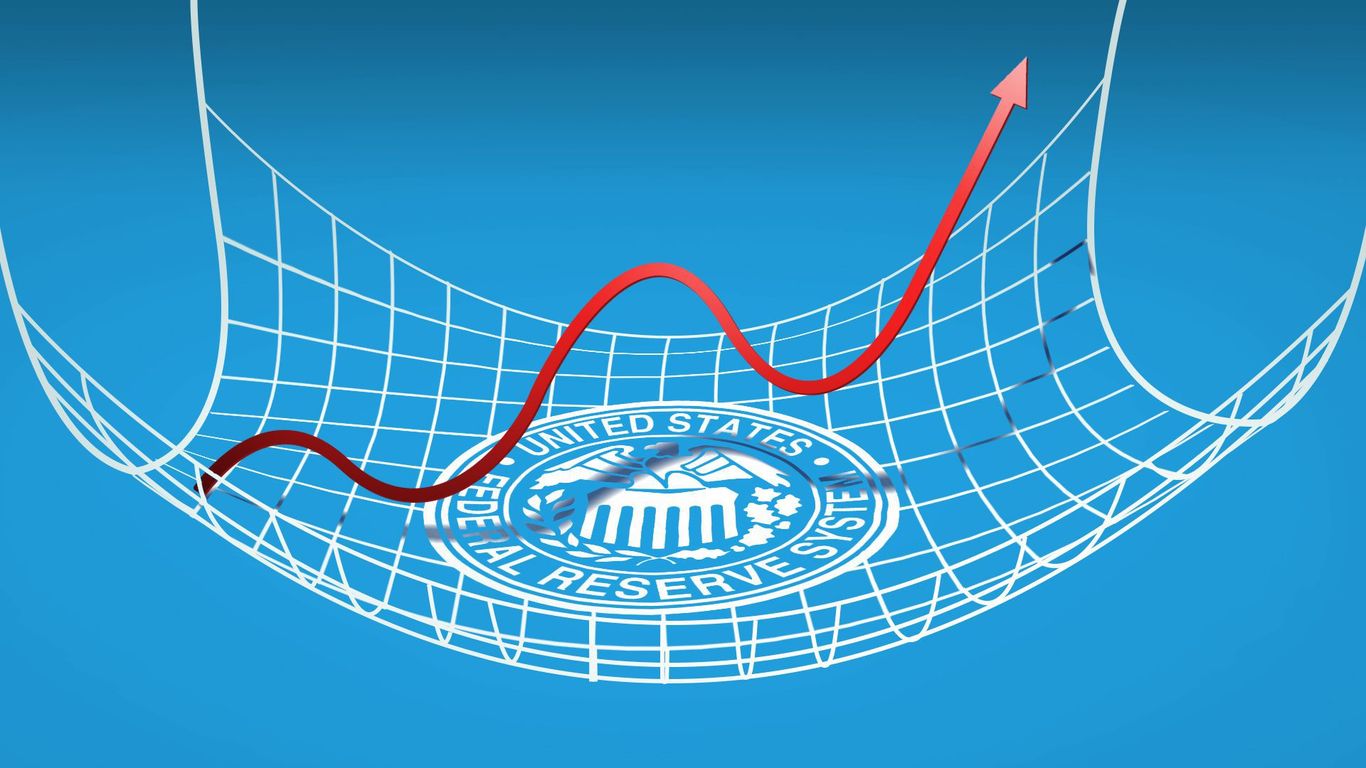

Why it matters: The equity market still has nearly blind faith that the Federal Reserve will bail it out in a time of crisis, and, progressively in the belief that the existing bout of inflation will be mainly short-lived.

- ” Now we simply see flashes of worry, and after that it disappears. There’s so much peace of mind originating from the Fed,” Kristina Hooper, primary international market strategist at Invesco, informs Axios.

State of play: Wednesday’s market shocks from the huge expose that the Fed may raise rates earlier than anticipated– in 2023– have actually currently been rather taken in.

The huge photo: In the last couple of months, the marketplace has actually brushed off frustrating tasks reports, remarkably high inflation development, and a hard-to-understand labor market imbalance

- The longest string of down days in the S&P 500 this year was one five-day duration, starting Feb. 16, according to S&P Global Market Intelligence. At the time, financiers were starting to cost in more powerful and quicker inflation.

- The S&P is up 14%for the year up until now.

Yes, however: Economic experts and experts continue to ignore a few of the dangers to the healing, especially visible with the missed out on agreement in current tasks and inflation information, Hans Mikkelsen, credit strategist at BofA, informs Axios (h/t to a current BofA report by Mikkelsen, believing that worry is temporal, for the turn of expression).

- ” I believe we’re undervaluing inflation. And I believe we are ignoring how rapidly the Fed is going to alter its tone,” Mikkelsen stated in an interview on Wednesday– even prior to the Fed’s newest projections came out.

The bottom line: Though markets still have broad assistance from the Fed, expect volatility in the next couple of months because approximating the speed of the healing has actually shown hard, Mikkelsen states.

Go much deeper: The day whatever– and absolutely nothing– altered for the Fed

No comments:

Post a Comment